As Bitcoin's price continues to show signs of an upward trend, several companies in the cryptocurrency and financial sectors are well-positioned to capitalize on this resurgence. Among them are MicroStrategy, Robinhood, Interactive Brokers, and Coinbase.

MicroStrategy

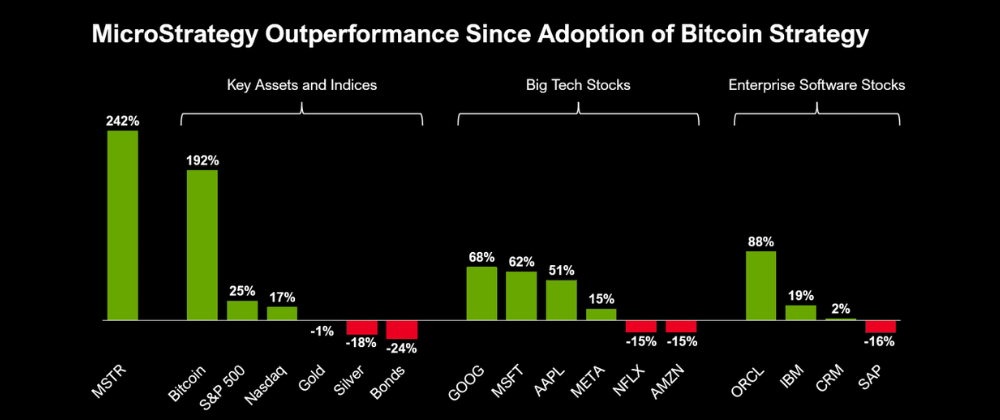

The business intelligence and software company has emerged as a prominent player in the cryptocurrency space, thanks to its aggressive investment strategy in Bitcoin. Under the leadership of CEO Michael Saylor, MicroStrategy has amassed a substantial Bitcoin holding, currently valued at over $13.5 billion. As Bitcoin's price rises, MicroStrategy's stock is expected to benefit significantly, as the company's fortunes are closely tied to the performance of the leading cryptocurrency. The company's recent inclusion in the prestigious MSCI World Index further solidifies its status as a major player in the global financial landscape, providing it with increased visibility and access to a broader investor base.

Robinhood

The popular trading platform has been expanding its cryptocurrency offerings, allowing users to buy, sell, and hold digital assets, including Bitcoin. As Bitcoin's price rises, Robinhood's cryptocurrency trading volume and revenue are likely to increase, as more investors seek exposure to the digital currency. Additionally, Robinhood's commission-free trading model and user-friendly mobile app have made it a go-to platform for many retail investors, positioning the company to capitalize on the growing interest in cryptocurrencies.

Interactive Brokers

The global electronic brokerage firm has been actively embracing the cryptocurrency market, offering its clients the ability to trade and hold various digital assets, including Bitcoin. As Bitcoin's price rises, Interactive Brokers' clients may increase their exposure to the cryptocurrency, leading to higher trading volumes and commissions for the company. Furthermore, the firm's reputation for providing sophisticated trading tools and research could attract more institutional and high-net-worth investors seeking exposure to Bitcoin and other cryptocurrencies.

Coinbase

As one of the largest and most well-known cryptocurrency exchanges, Coinbase is poised to benefit significantly from Bitcoin's uptrend. The company generates revenue from trading fees, as well as from its custody and lending services. As more investors and institutions seek to buy, sell, and hold Bitcoin, Coinbase's trading volume and revenue are expected to rise. Additionally, the company's recent expansion into new products and services, such as its decentralized wallet solution, could further diversify its revenue streams and solidify its position in the rapidly evolving cryptocurrency ecosystem.

These companies, with their diverse offerings and strategic positioning in the cryptocurrency market, are well-positioned to capitalize on Bitcoin's resurgence. As the digital currency continues to gain mainstream adoption and institutional acceptance, the demand for the services and products provided by these companies is likely to increase, driving their growth and profitability. Investors may find these companies attractive investment opportunities as they seek to benefit from the potential upside of Bitcoin's uptrend.

Oldest comments (0)