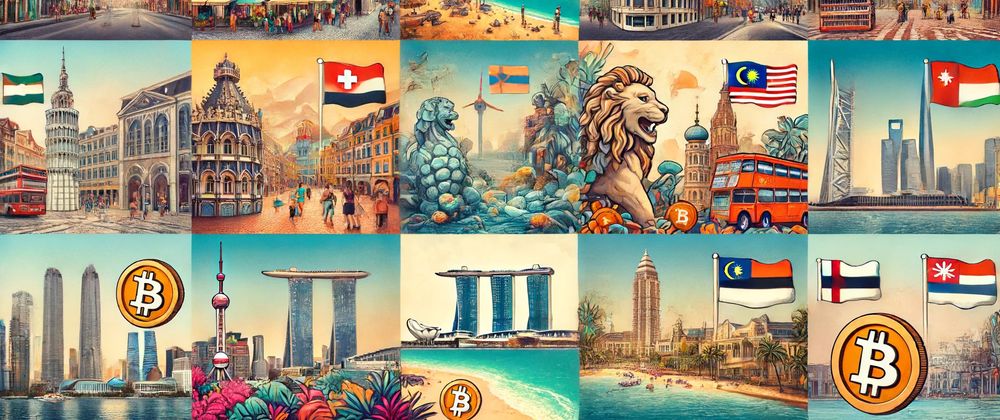

If you're looking for countries with reduced or zero crypto taxes, several destinations offer favorable conditions for cryptocurrency investors and traders. Here are some of the best options:

Portugal

Portugal is one of the most crypto-friendly countries in Europe. Individual investors are exempt from capital gains and income taxes on cryptocurrency profits. Additionally, there is minimal bureaucracy around crypto reporting and favorable residency programs for crypto investors and remote workers.

Singapore

Known for its favorable business environment, Singapore does not impose capital gains tax on cryptocurrency transactions. While businesses dealing in crypto might be subject to income tax, the rates are generally lower than in many other countries.

Switzerland

Switzerland, particularly the canton of Zug (often referred to as "Crypto Valley"), offers significant tax advantages. Individual investors do not pay capital gains tax on crypto profits, although income from mining and wealth tax on total net worth might apply depending on the canton.

El Salvador

El Salvador, the first country to adopt Bitcoin as legal tender, has no capital gains tax on Bitcoin since it's treated as currency. The country also offers reduced taxes on crypto income and easy residency for crypto entrepreneurs.

Malta

Malta, often called "Blockchain Island," does not tax long-term capital gains from crypto. However, business income from crypto trading might be taxed depending on the residency status and activity level (Mudrex - Invest in Bitcoin & Crypto) (coin bureau).

Cayman Islands

The Cayman Islands offer a tax-neutral environment with no income, capital gains, corporate, or withholding taxes on crypto transactions. This makes it a highly attractive destination for crypto businesses and investors (Mudrex - Invest in Bitcoin & Crypto) (coin bureau).

United Arab Emirates (Dubai)

Dubai offers a tax-free environment for personal income and capital gains, making it a prime location for crypto entrepreneurs and investors. The regulatory environment is also supportive of blockchain and fintech innovations (PlasBit - Cryptocurrency Exchange) (Mudrex - Invest in Bitcoin & Crypto).

Malaysia

Malaysia does not impose a capital gains tax on cryptocurrency trades. It also offers favorable residency options, such as the digital nomad visa, which exempts income earned outside the country from taxation (Mudrex - Invest in Bitcoin & Crypto) (coin bureau).

Estonia

Estonia provides a progressive digital infrastructure and favorable tax policies, with no capital gains tax on crypto profits for individuals and a low corporate tax rate for businesses.

Each of these countries has its unique advantages, from tax benefits to supportive regulatory environments and residency options. When considering relocating, it's essential to evaluate all aspects, including cost of living, quality of life, and potential changes in tax policies.

Top comments (2)

What about for companies? This list is for individuals, right?

Yeah, this is for individuals only. I'll make a list for companies shortly.