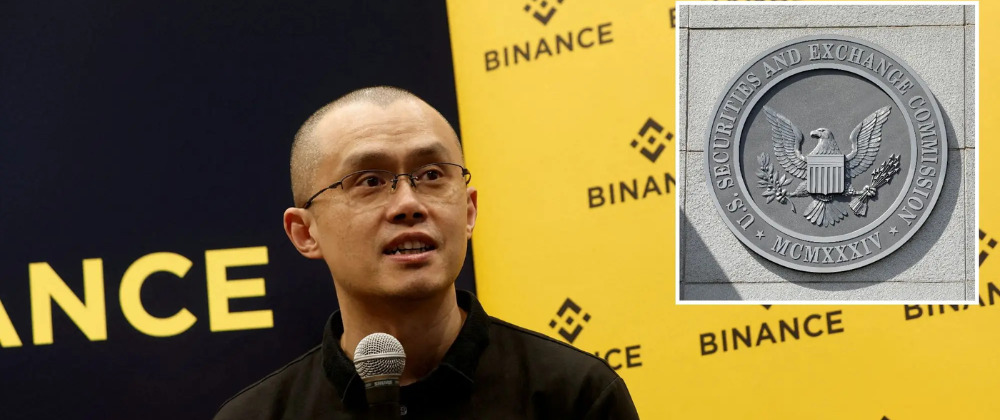

The U.S. Securities and Exchange Commission (SEC) has been allowed to move forward with a significant portion of its lawsuit against Binance, the world's largest cryptocurrency exchange, and its CEO Changpeng Zhao. This ruling deals a major blow to Binance as the case proceeds.

The SEC originally filed the lawsuit in June 2023, alleging 13 charges against Binance and Zhao, including operating unregistered exchanges, misrepresenting trading controls on Binance.US, and engaging in the unregistered offer and sale of securities. The regulator claims Binance commingled billions in customer funds with an outside entity controlled by Zhao and allowed high-value U.S. customers to secretly continue trading on Binance.com despite public statements to the contrary.

In September 2023, Binance, Binance.US and Zhao filed to dismiss the SEC lawsuit, arguing the regulator was overreaching by alleging securities law violations and defining "investment contract" too broadly. They also invoked the "major questions doctrine", a Supreme Court ruling that federal agencies should await Congressional authority over significant economic issues. However, a U.S. judge has now ruled that most of the SEC's case can move forward, rejecting the defendants' request for dismissal.

This development is a setback for Binance, as the SEC will be able to pursue its allegations that the exchange and Zhao mishandled customer funds, misled investors and regulators, and broke securities rules. The regulator is seeking to establish that Binance.US, touted as an independent platform for U.S. investors, was actually controlled by Zhao and Binance behind the scenes.

The SEC's lawsuit also targets 12 different crypto assets, including Solana's SOL and Polygon's MATIC, describing them as unregistered securities offerings. If the SEC prevails, it could have far-reaching implications for the crypto industry, potentially classifying many digital assets as securities subject to strict regulations.

Binance has expressed disappointment with the SEC's actions, stating they have cooperated with investigations and sought a negotiated settlement. The exchange contends customer funds have always been safe and secure on their platforms. However, the SEC Chair Gary Gensler has accused Binance and Zhao of violating federal laws and engaging in conflicts of interest.

The ruling allowing the SEC's lawsuit to proceed comes amid ongoing efforts by U.S. regulators to properly oversee the crypto industry. Earlier this year, crypto exchange Bittrex was sued by the SEC for breaking securities laws, and Coinbase is expected to face action from the regulator as well.

As the case against Binance and Zhao moves forward, it will be closely watched by the crypto community and regulators worldwide. The outcome could have significant implications for the future of cryptocurrency exchanges and the regulatory landscape surrounding digital assets.

Top comments (1)

I’m still in shock that CZ was funding terrorism. I thought it could be bad, but not that bad.