The latest U.S. inflation data has had a significant impact on the cryptocurrency market, with Bitcoin jumping above $59,000 in response to the unexpected dip in the Consumer Price Index (CPI) for June.

Inflation Turns Negative

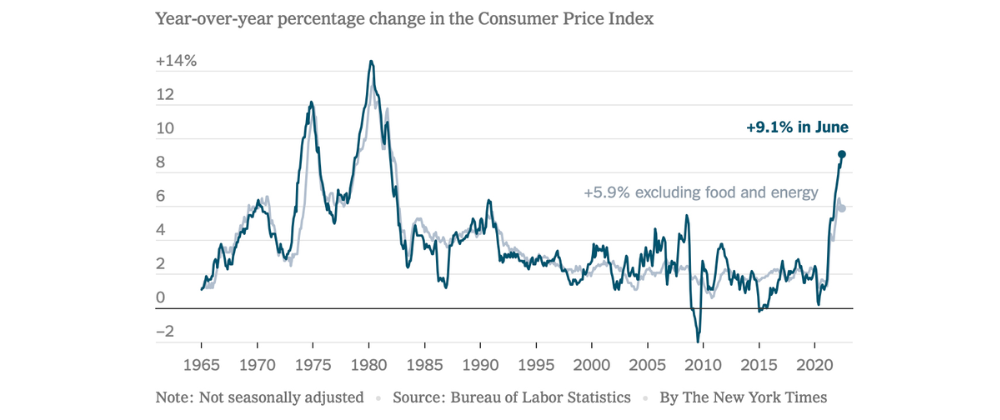

According to the Bureau of Labor Statistics, the CPI decreased by 0.1% in June, marking the first negative reading since May 2023. This came as a surprise to analysts, who had been expecting a 0.1% increase. Year-over-year, inflation rose 3.0%, slightly below the previous month's 3.3% and the expected 3.1%.

Bitcoin's Bullish Response

The drop in inflation sparked a bullish reaction in the crypto markets, with Bitcoin surging to over $59,000 shortly after the CPI report was released. Investors saw the softer inflation data as a sign that the Federal Reserve may keep interest rates low for longer, making money more accessible and giving investors more disposable income to allocate to assets like Bitcoin.

Fed Rate Cut Speculation

The unexpected inflation data has also fueled speculation about potential Federal Reserve action. The odds of a rate cut in September have surged to 87%, according to The Wall Street Journal, as investors bet on lower borrowing costs in the near future. This has led to a bullish surge in U.S. stock index futures and a notable drop in the 10-year Treasury yield.

Staked Ether Nears Record High

The positive market sentiment has also extended to the Ethereum ecosystem, with the amount of Ether staked nearing a record high. As of the latest data, 33.3 million ETH, or 27.7% of the total supply, has been staked, a sign that investors are increasingly locking up their Ether in anticipation of potential Ether spot ETF approval in the U.S.

Broader Economic Implications

The decline in inflation and the subsequent market reactions are part of a broader economic trend. The June CPI reading marks the third consecutive month of declining inflation, a trend not observed since May 2023. This could indicate that the Federal Reserve's monetary policy tightening is starting to have the desired effect on price pressures.

Cautious Optimism

While the initial market reaction to the inflation data has been positive, with Bitcoin surging above $59,000, the cryptocurrency has since retraced its gains and is currently trading around $57,800. This suggests that investors remain cautious and are waiting for further confirmation from the Federal Reserve before committing to a sustained rally.

In conclusion, the unexpected drop in U.S. inflation has had a significant impact on the cryptocurrency market, with Bitcoin jumping above $59,000 in response to the data. The softer inflation reading has fueled speculation about potential Federal Reserve rate cuts, which has boosted investor sentiment and led to a surge in staked Ether. However, the market remains cautious, and the long-term implications of the inflation data will depend on the Federal Reserve's policy decisions in the coming months.

Latest comments (1)

Lower inflation's got everyone excited. Looks like crypto and the economy are playing tag - when one moves, the other follows. Keep your eyes peeled, folks - this ride's just getting started! 💸😃