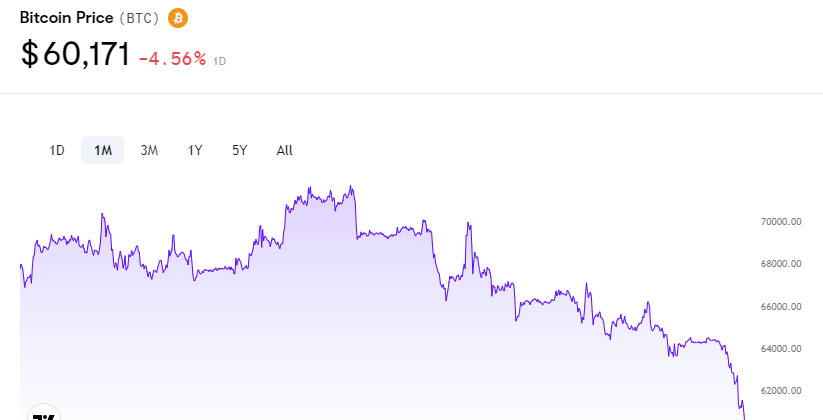

Bitcoin price has dropped below $60,171 as the market correction deepens. This sudden decline has led to the liquidation of over 60,000 traders, causing significant disruption in the crypto ecosystem.

The cryptocurrency market experienced a significant shock earlier this week when the price of Bitcoin abruptly fell from over $64,000 to less than $60,171 in a matter of hours, reaching its lowest level in several weeks. This dramatic drop resulted in the liquidation of more than 60,000 traders, totaling losses of more than $130 million in a single day. Traders were caught off guard by this rapid descent, which was exacerbated by a series of automatic liquidations on trading platforms.

This sudden drop in Bitcoin's price comes after an already tumultuous week. The leading cryptocurrency had reached a weekly high of $67,000 last Tuesday, but bearish trends quickly took over, pushing the price down to $63,500 on Friday. The weekend was relatively calm, with Bitcoin stabilizing around $64,000, before the Asian markets opened on Monday morning, causing another significant drop.

The decline in Bitcoin's price has also heavily impacted altcoins. Cryptocurrencies like Ethereum, Binance Coin, and Cardano saw their value drop by around 4%, while memecoins suffered even more severe losses. FLOKI plunged by more than 12%, closely followed by WIF, BRETT, PEPE, and BONK, all of which posted double-digit declines.

Several factors have contributed to this sudden drop in Bitcoin's price. One key factor is the significant decrease in whale transactions, which have dropped by 42% over the last two days, falling from 17,091 to 9,923. Additionally, there has been a wave of withdrawals, as some traders on derivative exchanges have gone into "risk-off" mode, reducing their risk exposure by withdrawing their assets from derivative platforms. The Interexchange-Flow-Pulse (IFP) indicator, which tracks Bitcoin movements between spot and derivative exchanges, has turned red, signaling a decline in market confidence.

Furthermore, the market was also impacted by massive outflows from spot ETFs. The previous week was marked by significant outflow, and this outflow dynamic has evidently contributed to the bearish pressure on the price of Bitcoin.

The combination of these factors has created a particularly fragile market environment, which likely led individual and institutional investors to liquidate their positions to avoid further losses, thereby amplifying the drop in Bitcoin's price.

As the correction deepens, it remains to be seen how the market will respond in the coming days and weeks. Investors and traders will be closely monitoring the situation, looking for signs of a potential rebound or continued downward pressure on Bitcoin's price.

Top comments (1)

What unique factors or market dynamics contributed to the sudden and significant drop in Bitcoin's price below $60k, and how might this impact the broader cryptocurrency ecosystem in the near-term?