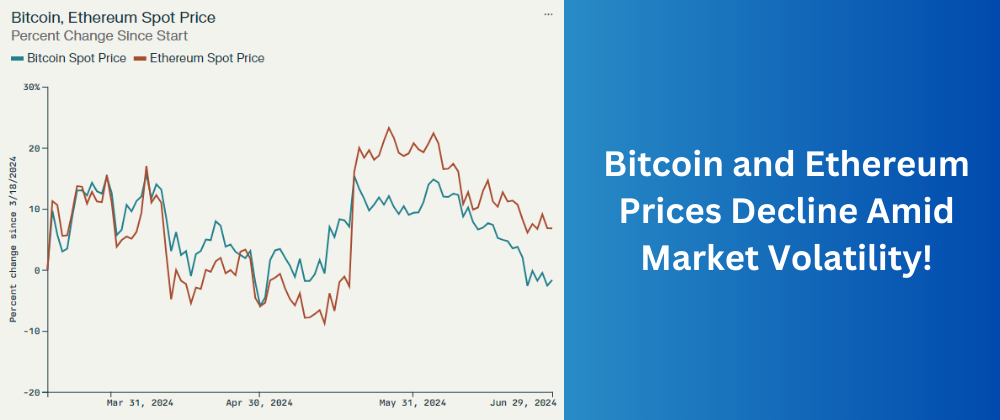

Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, have seen a decline of over 1% in their prices over the past 24 hours. Bitcoin is currently trading around $58,250, while Ethereum is trading around $3,160.

The recent price decline can be attributed to a few factors. Firstly, the broader cryptocurrency market has been experiencing a period of volatility and uncertainty. Macroeconomic factors, such as concerns over inflation and the potential for interest rate hikes by central banks, have been weighing on investor sentiment. This has led to a general risk-off attitude, with investors becoming more cautious and reducing their exposure to riskier assets, including cryptocurrencies.

Additionally, the recent regulatory crackdown on the cryptocurrency industry in various jurisdictions has also contributed to the market's volatility. Governments and regulatory bodies around the world have been increasing their scrutiny of the crypto sector, leading to concerns about the long-term viability and adoption of digital assets.

Despite the recent price decline, it's important to note that both Bitcoin and Ethereum have experienced significant gains over the past year. Bitcoin, for instance, has more than doubled in value since the beginning of 2023, while Ethereum has seen an even more impressive rally, with its price increasing by over 80% during the same period.

The long-term outlook for both cryptocurrencies remains positive, as they continue to gain mainstream adoption and recognition. Bitcoin, often referred to as "digital gold," is increasingly being seen as a store of value and a hedge against inflation, while Ethereum's blockchain technology has become the foundation for a wide range of decentralized applications and the growing decentralized finance (DeFi) ecosystem.

Moreover, the approval of Bitcoin and Ethereum exchange-traded funds (ETFs) in various jurisdictions has been a significant catalyst for the increased institutional investment in these assets. As more traditional financial institutions and investors enter the crypto space, it is expected to drive further growth and stability in the market.

In conclusion, the recent price decline in Bitcoin and Ethereum is part of the inherent volatility of the cryptocurrency market. However, the long-term fundamentals of these assets remain strong, and they continue to attract increasing attention and adoption from both retail and institutional investors. As the crypto industry matures and regulatory frameworks become more established, it is likely that we will see more stability and sustained growth in the prices of these leading digital assets.

Top comments (0)